Week of 18 to 24 October 2021

China and the PICs talk nuclear

Per the joint statement from the inaugural China-Pacific Island Countries Foreign Ministers’ Meeting on 21 October:

“All parties reaffirmed their firm position of upholding the international non-proliferation regime with the Treaty on the Non-Proliferation of Nuclear Weapons as its cornerstone and the South Pacific Nuclear Free Zone, and called on the relevant parties to fulfill treaty obligations and promote regional peace and stability.”

Quick take:

Another week, another seemingly successful effort by Beijing to regionalise its concerns about AUKUS. Although the “relevant parties” weren’t mentioned by name, the language bears an uncanny resemblance to the misgivings about AUKUS that China has been driving home for weeks via the state-controlled/affiliated press and Chinese officials. The regular Ministry of Foreign Affairs press conferences repeatedly made similar points last week (here, here, here, and here), albeit with more detailed and rhetorically charged language.

Of course, it’s possible (but unlikely?) that this language wasn’t directed at the AUKUS countries. This was the first China-Pacific Island Countries Foreign Ministers’ Meeting, so there’s no real historical baseline for these joint statements. But in the context of Beijing’s sustained and multi-pronged effort to raise many of the same concerns about AUKUS, it’s hard to not read this as a thinly veiled objection to AUKUS. As a resident power in the South Pacific neighbourhood, the statement also reads particularly pointedly for Australia.

Coming on the back of similar messaging from Indonesia and China the week before last, Beijing’s anti-AUKUS diplomacy seems to be gaining ground in Australia’s immediate region. To be sure, there are AUKUS supporters in South-East Asia, most notably the Philippines and Singapore. But South-East Asia and the Pacific also seem to be home to widespread AUKUS scepticism. And Beijing shows every sign of leveraging this in a bid to inflict reputational damage on AUKUS and, by extension, Australia.

This poses a direct challenge to Canberra. South-East Asia and the South Pacific have long been key areas of focus for Australian foreign and defence policy. Per the 2020 Defence Strategic Update: The “immediate region [ranging from the north-eastern Indian Ocean, through maritime and mainland South East Asia to Papua New Guinea and the South West Pacific] is Australia’s area of most direct strategic interest. Within it, Australia must be capable of building and exercising influence in support of shared regional security interests.” China’s coordinated diplomatic messaging on AUKUS with both Indonesia and the Pacific Island Countries seems to directly challenge Australia’s goal of “building and exercising influence” in its “immediate region.”

Will these coordinated expressions of AUKUS scepticism allow China to substantially change how countries in the region view Australia? That remains unclear. But at a minimum, Beijing has shown itself capable of using its diplomatic engagements in the region to: amplify and complement its own concerns about AUKUS; give its opposition to AUKUS added international legitimacy; and portray the US and its allies as rule breakers and, by extension, portray itself as a responsible power. AUKUS’ capability gains notwithstanding, China’s ability to coordinate concern about the trilateral security partnership looks set to create enduring difficulties for Australian diplomacy in its immediate region.

Latest export data

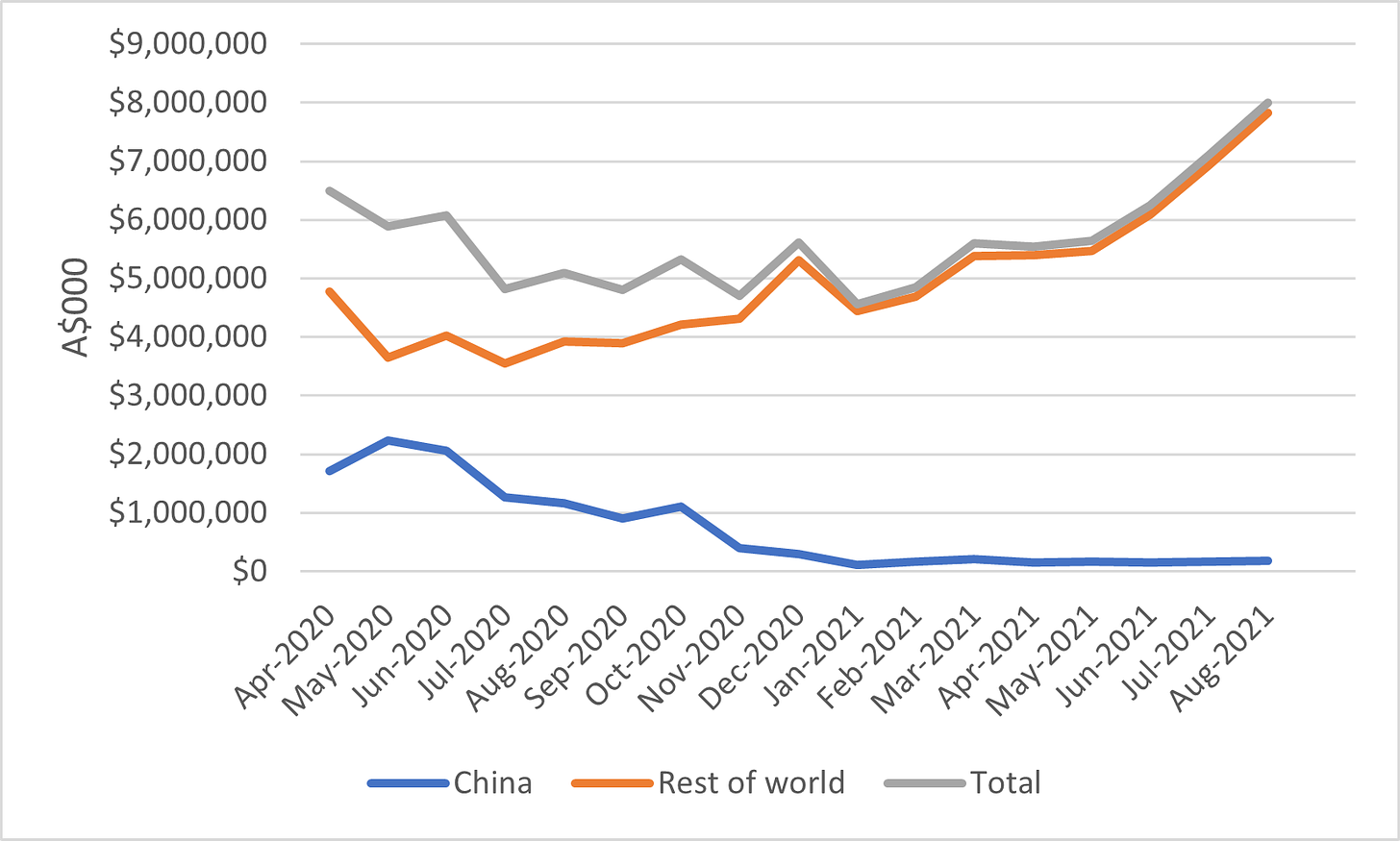

The latest trade data of the combined monthly value of Australia’s nine exports targeted by China’s trade restrictions (to China, the rest of the world, and total, April 2020 to August 2021):

Quick take:

The latest round of trade data from August again tells a relatively upbeat story about Australia’s exports. The above graph covers all nine exports impacted by China’s confirmed trade restrictions: barley, beef, cotton, timber products, coal, copper ores and concentrates, sugar products, crustaceans, and wine. As they have for effectively all of 2021, the value of exports of coal, copper ores and concentrates, and barely to China were still flatlining at zero in August. Meanwhile, there was no significant uptick in the value of other targeted exports to China, which remained down on their levels prior to the introduction of trade restrictions.

But the total value of the nine targeted exports to the rest of the world continued to surge in August. Although the value of these exports to China in August 2021 was approximately 1% of its value in April 2020, the value of these same nine exports to the rest of the world in August 2021 was approximately 164% of its value in April 2020. Presumably the rise in the value of the nine targeted exports to the rest of the world has been boosted by the ongoing growth in coal prices. But even excluding coal from the mix, the value of the other eight Australian exports to the rest of the world in August 2021 was approximately 190% of its value in April 2020. So, despite China’s ongoing trade restrictions, the latest export data suggests successful export redirection to alternative markets.

The way we were

Dan Tehan, Minister for Trade, Tourism and Investment, speaking to Sky News Australia’s Laura Jayes on 21 October:

“Look, we will continue to keep making the case that our bilateral relationship is incredibly important and the way we engage is incredibly important and especially how we do that economically, because that’s how both countries benefit, and we’ll continue to make that case. … [T]he economic relationship can help both countries, and we want to get back to how it was before 18 months ago.”

Quick take:

The Australia-China relationship continues to tread water. It’s been just shy of 1.5 years since Beijing first imposed politically motivated trade restrictions and it’s been some 21 months since an Australian minister was able to speak to their Chinese counterpart. But despite this frostiness, Minister Tehan continues to patiently wait for dialogue with China. In case there were any doubts in Beijing, the Minister has emphasised and reemphasised his forbearance again and again.

Australia’s statement to the Word Trade Organization’s Trade Policy Review of China was equal parts a strong defence of the rules-based trading system and a criticism of Beijing’s trade coercion. But despite this tough message for China, the Australian government and the Trade Minister have consistently and clearly stated that Canberra seeks to “constructively cooperate” with Beijing and that Australia’s trade policy concerns are specifically focussed on China’s deviation from the principles of the rules-based trading system.

Will Canberra’s patience get the relationship back to the way it was before? Incoming bumps in the bilateral relationship don’t augur well for a return to the old ways. These include the politics of the Beijing 2022 Winter Olympics and a range of decisions on the horizon over the Darwin Port, the use of the amended Autonomous Sanctions Act 2011, and Confucius institutes in Australia.

But at the very least, hopefully Beijing appreciates the Trade Minister’s patience and will reciprocate with a letter. As the Minister has stressed recently, Beijing has good reason to do so. China’s accession to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership will likely depend on the resumption of ministerial contact.

As always, thank you for reading and please excuse any errors (typographical or otherwise). Any and all objections, criticisms, and corrections very much appreciated.